Marketing budgets in the wake of Big Tech: Why it’s time for new approaches

W&V: Interview with Norman Wagner, Managing Director DACH at Utiq

More independence in the digital advertising business: risks, resilience and opportunities beyond big tech

- what specific risks arise for companies if they continue to rely heavily on Big Tech advertising platforms and what costs are underestimated?

Norman Wagner: Anyone who continues to invest a large part of their advertising budget in Google, Meta, TikTok & Co. is relying on proven channels, but ignoring considerable risks and hidden costs. Rising advertising prices in the walled gardens are a key problem. For example, the average CPMs on Facebook in 2024 are 36-69 % higher than in the previous four years. As a result, many companies are paying a premium for the Big Tech comfort zone. At the same time, transparency suffers: closed platforms often act as a black box in which advertisers can hardly understand where every euro goes. The metrics and attribution come from the platform itself, which can undermine trust.

There is also a considerable brand safety and reputation risk. Meta, for example, recently softened its moderation rules, which could lead to a flood of unverified content. Many advertisers feel trapped in the “digital dilemma”: They see the problems, but believe they cannot do without these platforms because of reach and targeting.

Another cost factor that is often underestimated is the loss of control over data and customer relationships. Those who advertise exclusively via big tech “borrow” reach under the platform’s conditions – but hardly build up their own first-party data or direct customer contacts. The platforms have the upper hand when it comes to data sovereignty and access. This comes back to haunt them as soon as the rules of the game change.

2 “Resilience” is currently a much-used term – how do you define it specifically in the context of the digital advertising business, and why should marketing decision-makers take a close look at it?

Wagner: In the context of digital advertising, we understand it to mean the resilience of marketing and media strategies in the face of disruption and change. Specifically, a resilient advertising system is diversified, flexible and less vulnerable when external shocks occur – be it regulatory cuts, technical upheavals or market shifts.

Why is this so important right now? Because the last few years have shown how fragile one-sided dependencies are. Examples include the Apple tracking opt-out (ATT), which suddenly restricted personalisation and measurement options in walled gardens, or Google’s announcement of the abolition of third-party cookies, which is shaking up an entire ecosystem. Resilience means being able to cushion such upheavals without marketing performance collapsing.

- what practical steps should brands take now to noticeably reduce their dependence on Google, Meta and co. without losing reach or performance?

Wagner: Brands can reduce their dependency without having to sacrifice reach or campaign success. The key lies in a clever diversification strategy and building up your own strengths. Here are some practical steps:

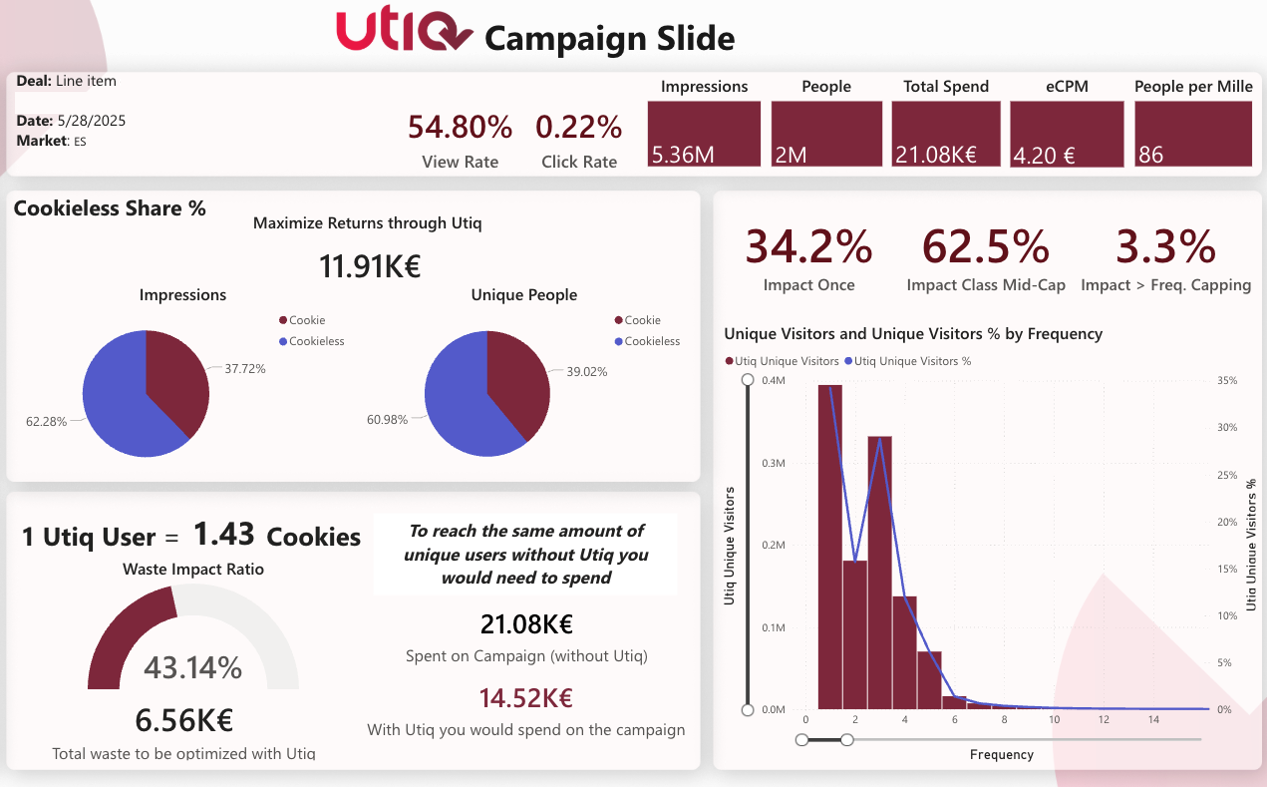

- Audit media mix: The first thing advertisers should do is take a ruthless inventory. Many realise that the ROI returns on some platform investments have long been declining. These funds can be gradually redirected to alternative channels. CTV platforms, for example, offer increasingly scalable reach in a more controlled environment. Campaigns can also use stable identifiers such as Utiq to target reach on the open web much more efficiently than was ever possible with cookies.

- Strengthen first-party data: A fundamental step out of dependency is to bring the database in-house. Those who invest in CRM, their own analytics and consent management will be able to segment and address target groups themselves in future – more independently of the data octopuses of the corporations. This also includes designing consent banners and opt-ins in such a way that users actually give informed consent.

- Use independent measurement: Instead of blindly trusting platform reports, third-party tools should be used for ad verification, traffic quality and advertising effectiveness. For example, solutions for click fraud detection and viewability measurement can show whether advertising budgets are being wasted in walled gardens (keyword: budget waste).

- Utilise industry initiatives: Finally, brands and publishers should work more closely together to reduce dependency on walled gardens. In Germany, for example, Initiative18 (an association of media and marketing experts) is pushing to avoid monopolisation in data and advertising technology by promoting diversity and innovation. Such initiatives bring stakeholders together to develop common standards (e.g. for ID solutions, data pools or fairer measurement methods).

4 Independence sounds good, but is often expensive or complex in practice. What short-term and long-term investments are needed to become independent of the walled gardens?

Wagner: The transition out of the walled gardens is indeed initially associated with expense. But you have to make a clear distinction between short-term investments and long-term returns.

In the short term, technological and organisational investments are particularly necessary. This includes setting up your own MarTech stack as an alternative to big tech tools. For example, many companies still reflexively resort to Google Analytics & Co.; switching to independent analytics tools (e.g. Matomo, Mapp or Piwik PRO in the EU) may incur initial costs, but brings complete data sovereignty and GDPR compliance and therefore fewer risks in the long term. European alternatives are now available for almost every US platform, often with a comparable range of functions. Implementing your own consent management platform or data management platform also requires human resources, but pays off in terms of data independence in the long term.

In the long term, these costs are often amortised. Because the real question is: What does it cost not to become more independent? Long-term investments are primarily made in your own strategic assets: data (setting up CRM data pools, possibly cooperations for data sharing in compliance with data protection regulations), content and community (strengthening your own channels so that reach is not just “rented”) as well as long-term partnerships (e.g. alliances such as log-in cooperations à la NetID in Germany or industry solutions such as Utiq for telco-based IDs). These investments are complex, but they create competitive advantages that last for years. For example, a wealth of first-party data that has grown over the years enables precise marketing in real time – something that would otherwise require expensive purchases from third-party providers.

In short: yes, it takes money and effort in the short term and strategic breath in the long term to get out of the walled gardens. But these expenditures are just that – investments, not mere costs

- can you give an example of where dependence on big tech has led to specific problems for a brand and how this could have been avoided?

Wagner: There are numerous scenarios that can serve as a warning signal. Let’s think of 2018, when Facebook suddenly changed its newsfeed algorithm and the organic reach of publisher and brand content plummeted. Many publishers who had made themselves comfortable in the so-called “Facebook referral traffic” lost a large part of their audience overnight – along with their advertising revenue.

A brand example: in 2021, a well-known fashion chain got into trouble because its ads suddenly appeared alongside extremist content on YouTube. The company faced a public shitstorm and was forced to withdraw its entire YouTube budget. Unfortunately, it had hardly built up any alternatives beforehand. Reach and online revenue plummeted.

Probably the most striking example of the recent past remains the Google “addiction clinics” case. In 2017, Google imposed a worldwide advertising ban on all addiction clinics without warning because some black sheep had come to light. The legitimate providers, who were fully dependent on AdWords, were suddenly faced with drastic losses and even the risk of insolvency. Google rowed back a year later and introduced certifications. But the damage was done. This episode illustrates how quickly a business model can be jeopardised when “all your eggs are in one basket” Big Tech.

Each of these examples demonstrates what dependency can lead to in extreme cases. It doesn’t always have to be a total ban on advertising – even minor changes are often enough to throw one-sided strategies off course. Brands and publishers should discuss such cases internally and see them as an incentive to create their own safety nets. Redundancy is not built up as an end in itself, but in order to remain capable of acting in the event of a crisis. If you have “Plan B and C” up your sleeve, you can react more calmly if Plan A suddenly breaks down.

6 How can the added value of “independent” advertising solutions be measured in concrete terms compared to traditional big tech offerings so that marketing decision-makers have a clear argument?

Wagner: Firstly, classic performance values can be used: Cost per acquisition, click and conversion rates, reach in the target group, etc. – all of these should be considered in an A/B comparison between big tech campaigns and independent approaches. Conversion lifts through new channels can also be demonstrated. If alternative placements (for example in quality journalistic environments) lead to higher actual sales per impression, you have a strong ROI argument.

In addition to direct performance indicators, reach and target group metrics also play a role. Independent solutions often develop their added value by opening up additional reach that would be difficult or expensive to achieve via big tech.

Decision-makers should utilise test-and-learn experiments and communicate the results openly. If it turns out, for example, that a European ad tech partner delivers better conversions at the same cost or that a data clean room solution provides more precise insights than Facebook Analytics, then you have clear arguments in your favour.

7) What role do data protection and GDPR compliance play in the discussion about greater independence – is this more of an opportunity or an additional burden for brands?

Wagner: Data protection and GDPR are first and foremost a set of rules that must be complied with. This compliance is non-negotiable, and yes, it requires investment. But in the discussion about greater independence, data protection acts more like a catalyst than a brake. It levels the playing field by limiting Big Tech’s unofficial competitive advantages (limitless data collection) and thus making room for alternative solutions. Although this means additional work for brands, it can pay off in the form of customer loyalty, brand trust and innovation leadership.

It would be wrong to view data protection solely as a burden – there is an enormous opportunity here. The large platforms are under massive pressure due to their data-intensive business models. European regulators are explicitly aiming to reduce the power imbalance between big tech and consumers and give people more control over their data.

For Big Tech, this means that its previous approach – e.g. personalised advertising without an explicit opt-in, as practised by Meta for years – will be radically restricted. In early 2023, the European Data Protection Board ruled that Meta can no longer interpret the use of its own services as blanket consent for personalised ads. Meta must now offer a genuine opt-in option – a major blow to the Group’s advertising business.

- how could C-level marketing decision-makers best convince other executives (such as CFO or CEO) to shift budgets from proven big tech platforms to new, independent solutions?

Wagner: There are powerful arguments that can be used to gain a hearing at C-level:

- Financial risk minimisation: a CFO thinks in terms of risks and returns. Concentrating the advertising budget on a few large players is a cluster risk – comparable to one-sided supplier dependency. Diversification in marketing is just as important as in the investment portfolio.

- Cost control and efficiency: Big tech is no longer a low-cost advertising channel, but often a high-price island. Studies (e.g. by eMarketer) show that the large platforms have strongly utilised their pricing power. CFOs, always concerned about cost efficiency, prick up their ears when it is pointed out: “We can reduce our cost-per-lead by advertising beyond the expensive platforms.”

- Resilience as a corporate goal: CEOs think more strategically and long-term. Resilience must be a company-wide goal, not only in the supply chain or production, but also in marketing. Anyone who takes sustainable business seriously will recognise that turning away from a one-sided fixation on big tech is a step towards greater entrepreneurial independence.

- Compliance and regulation: Both CFOs and CEOs are pricking up their ears when it comes to avoiding legal risks. Developments such as the Digital Services Act, the Digital Markets Act or stricter interpretations of the GDPR make it likely that current advertising methods will be regulated or restricted in the future. A CFO does not want to risk a million-euro fine, a CEO does not want to risk a loss of reputation.

9 Do you see Europe in a realistic position to establish a serious alternative to the globally dominant platforms – or does “independence” remain wishful thinking?

Wagner: Europe has taken substantial steps in recent years to counter the advertising duopoly (or triopoly with Amazon). Regulation through the Digital Markets Act (DMA) aims to limit the market power of gatekeepers and promote competition, e.g. through interoperability requirements or the ban on favouring own services. These rules could create opportunities for European alternatives – for example, by giving smaller providers access to data interfaces and allowing them to offer services based on these. The European Digital Advertising Alliance or state-funded projects such as GAIA-X in the cloud sector also demonstrate the political will to promote technological independence.

There are also European companies with great potential in the adtech and media sector. It is easy to forget that some leading adtech companies come from Europe: Adform from Denmark, Virtual Minds from Germany, Equativ from France – all globally successful DSP and SSP platforms that stand for transparency and data protection. Criteo from France was a long-time pioneer in retargeting and is now repositioning itself in retail media. Smartclip/RTL and Teads (outstream video) are further examples of European innovative strength. There are also initiatives such as netID (a European foundation) or Utiq (a transnational telco co-operation for digital IDs).

At the same time, we must remain realistic: The market dominance of the large platforms is based on massive network effects and capital advantage. It would be naïve to believe that Europe could establish a completely separate advertising market in a short space of time that competes on an equal footing.

A scenario of partial independence is more realistic: Europe can organise critical parts of the infrastructure (e.g. ID management, measurement systems, programmatic platforms) itself so that market participants in this country are not 100% dependent on the mercy of Google, Meta & Co.

- if brands do not embrace independent solutions, what long-term strategic disadvantages could arise that are perhaps barely perceptible today?

Wagner: A key risk is the perpetuation and intensification of the spiral of dependency. The longer you delay, the more difficult it will be to break out later. If Big Tech continues to expand its dominance – and there is much to suggest that it will – alternative structures will be increasingly weakened. At some point, the point could be reached where Google & Co. are effectively the only gatekeepers to digital reach. The negotiating power of advertising customers will then shrink to zero. They would be forced to accept higher prices and more restrictive conditions every year in order to reach consumers. Such a monopoly rent situation would put a strain on marketing budgets and eat into margins.

The ability to innovate also suffers. Those who rely entirely on the large platforms relinquish part of their strategic control. New forms of advertising and targeting methods are then exclusively dictated by the platforms. Companies risk becoming reactive users instead of active creators.

In the long term, there is also the threat of a loss of substance in the media landscape, which will also damage the brands themselves. Initiative18 warns that ever greater investment in ever fewer platforms will cause independent journalistic media to dry up. If this trend continues, the supply of high-quality, trustworthy advertising environments could shrink drastically in just a few years. And brands would hardly find any brand-safety-compliant alternatives outside the big tech universes.

There is still time to take countermeasures. Every diversification measure initiated now, every euro spent on an alternative offering, every solidarity in the industry strengthens the foundations for tomorrow. Independence is not a luxury, but a strategic necessity – and the best time to tackle it is now.